With the accelerated digital transformation over the past few years, businesses of all kinds have expanded their global reach – a historically unlikely capability. However, the global economy’s rapid growth has turned cross-border payments from an occasional nuisance to a critical priority as businesses navigate sending trillions of dollars internationally.

The intricacies of currency conversions and global operations often bog down businesses and vendors trying to send mass payouts worldwide. Even if the demand and an opening to grow are clear, it doesn’t matter if an organization doesn’t have the resources to keep up. Scaling up and scaling globally shifts an opportunity into a complex challenge as more and more payments need to be sent out daily.

While global payments may be daunting for a scaling company, they don’t have to be. Despite the labyrinth of processes it takes to pay vendors and contractors abroad, companies can use several straightforward strategies to execute their global payouts while maintaining steady vendor and contractor relationships.

Get familiar with global payment options

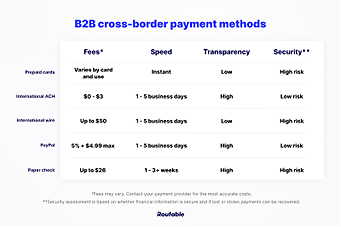

There is no one-size-fits-all option for international payments. International ACH is typically a cheaper and more secure option for global payments and is available in most countries.

SWIFT international wire is available globally but is a more expensive option with more risk. Therefore, understanding the available payment methods is critical to sending global payments safely and cost-effectively.

Unlike domestic payments, cross-border transactions are complex and nuanced, introducing variations that have traditionally led to slow settlement and drawn-out reconciliation.

Seek out a payment solution that has multiple options for payment methods, giving you the flexibility to pay your vendors faster and in their preferred payment method.

Additionally, your payment platform should offer complete transparency into fees and currency conversion rates for every transaction.

Build with scale in mind

Application Programming Interfaces (APIs) eliminate the need for finance teams to memorize international policies or track currency conversion rates with software that will do it for them. However, not all APIs are created equal.

When expanding into a global market, it is crucial to have an API that can scale as your payments grow. Seek out an API that can handle high-volume AP (also known as mass payouts) so that your cross-border payments can increase as you scale. For companies in the gig economy or marketplaces – a scalable API that lets you sync payment and contractor data in real-time can be the differentiator between a vendor or gig worker choosing your business over another.

Know how many payments you’re sending

If your business is only working with a few global vendors, you may be able to handle your payments manually. But as the number of payouts increases and your international business expands, the hours spent on data entry alone could be enough to bog down the whole operation.

When sending global mass payouts, automation can become a key differentiating factor in the ability to scale. Look for systems that allow automated data entry, two-way data sync, and automatic importing/exporting.

Adopt a vendor-first mindset

User experience is critical to cross-border payments, as businesses face new challenges like language barriers, slower transfer speeds, and currency conversion.

Part of ensuring successful global payments management is creating a vendor onboarding experience that makes it easy and seamless for vendors to receive payment. Seek payment solutions that allow for a local portal in each country, so vendors can onboard themselves and set up their bank and tax information in one place.

Find partners that keep things simple

Payment platforms like Routable help manage the complexity of cross-border payments, allowing finance teams to choose convenient payment methods and processing speeds. They rely on an easy-to-scale API, establish preferred controls in AP workflows, and gain transparency into currency conversion rates and fees while providing a user-friendly vendor experience.

About the Author

Omri Mor is the Co-founder and CEO of Routable, responsible for the company’s overarching vision and business strategy. He is hyper-focused on providing tangible value for Routable’s customers and approaches every business decision with a customer-first mindset. Omri is a serial entrepreneur with a track record of successful exits. Prior to Routable, he spent more than five years building fintech infrastructure for marketplaces to improve consumer check-out conversion rates. Omri earned his BA in Business Administration from the University of Washington.