By Jeff Domansky

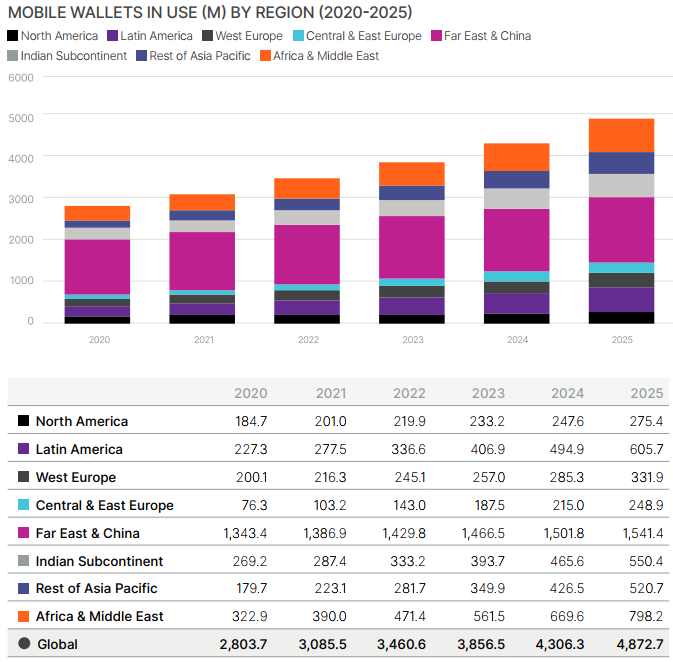

With more than 2.8 billion mobile wallets in use worldwide at the end of 2020 and the impact of the pandemic, you’d think US consumers would be quicker to adopt mobile wallets than developing countries.

You’d be wrong.

New research from Boku predicts the mobile wallet adoption gap between North America and the rest of the world will continue to grow through 2025. Nearly 60% of the world’s population will use a mobile wallet by 2025 – that’s 4.8 billion mobile wallets. But the growth will be much faster in developing countries.

In addition, merchants face challenges ahead. “Between 2020 and 2025, the number of mobile wallets transacting over $1 billion per year will increase by 27%, creating a growing acceptance challenge for merchants,” the 2021 Boku Mobile Wallets Report predicts.

Card-based mobile wallets lag faster-growing stored value wallets

Part of the explanation for the slower adoption of mobile wallets in Western Europe and North America is the legacy card payment system. Consumers in developed nations love their debit and credit cards. In the future, this divide will grow between card-based mobile wallets and stored value wallets more common in developing countries.

“While mobile wallets are being used on a global basis, we see two distinct types being used today. One is card-based mobile wallets, like Apple Pay and Google Pay, which provide an easier way to pay with cards people already have. The other is stored value mobile wallets, like AliPay and GrabPay, that enable consumers to transact with digital cash and are popular in emerging markets with fast-growing e-commerce sectors,” said Adam Lee, Chief Product Officer at Boku.

“The markets that are set to grow the fastest are those with the lowest levels of card penetration, stored value wallets are thriving. In North America and Western Europe, which are dominated by card-based mobile wallets, we are seeing the slowest growth in mobile wallet adoption, as the technology provides merely incremental benefit,” Lee added.

Are merchants ready to accept many more mobile wallet payment choices?

Boku’s research shows the number of mobile wallets transacting over $1 billion per year will grow by 27% from 54 wallets in 2020 to 69 wallets by 2025. While an exciting growth opportunity for merchants, it comes with a set of new challenges.

Merchants must figure out the most efficient, cost-effective way to accept mobile payment options in the future. Boku also cautions merchants will need to take more than one and possibly numerous mobile wallet payment choices.

Consumers in high-growth markets such as India and Indonesia use an average of 2.74 wallets. So not only do merchants need to accept wallets, but they also need to ensure broad coverage across each target market. That’s a big challenge arriving at the point of sale soon.

“For global merchants, mobile payment acceptance is not about accepting one type of mobile wallet or another, but ensuring that consumers in every market will have the required selection on payment types in order to monetize transactions,” said Jon Prideaux, CEO at Boku. By 2025, that capability will grow exponentially.

Which markets will adopt mobile wallets fastest?

Emerging e-commerce markets will outpace growth in developed countries, and mobile wallets will lead it.

“Mobile wallets have lowered the barrier to making digital payments and in parallel ushered billions of new consumers into eCommerce. These consumers are not in North America or Western Europe, they are in emerging markets, and while they don’t have credit cards, they overwhelmingly have mobile wallets,” Prideaux added.

Boku’s research highlights the markets where the annual growth rate in mobile wallet use will be fastest. SE Asia mobile wallet users will grow by 311% to reach 39.7 million mobile wallets by 2025.

Africa and the Middle East show the second-biggest growth at 147%, reaching 798.2 million users by 2025.

China’s market will reach maturity with an estimated 1.54 billion mobile wallet users. South Korea, Taiwan, and Japan are primed for hypergrowth and expected to reach a combined 98.4% adoption in 2025.

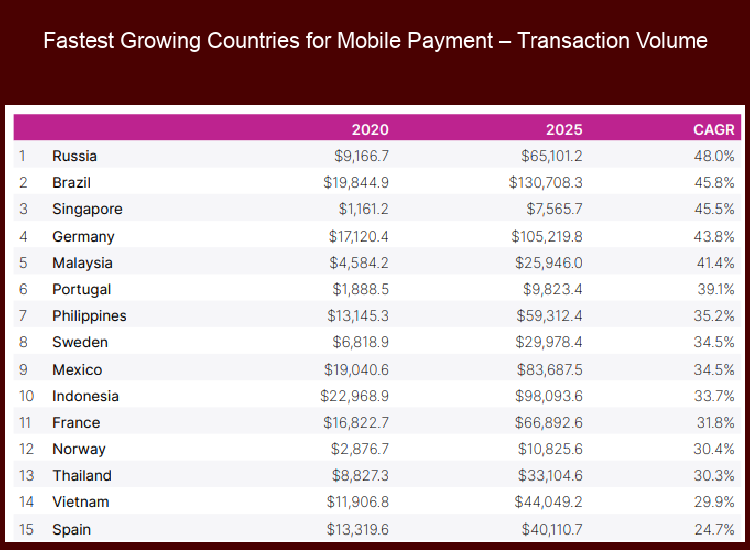

Growth rate off the chart in central Europe and SE Asia

The five-year compound annual growth (CAGR) in projected transaction volumes for the 20 largest countries using mobile wallets is eye-opening. Russia is set for the highest projected growth reaching $65.1 billion in transactions, a 48% growth from 2020 to 2025.

Following is Brazil (+45.8%, $130.7 billion), Singapore (+45.5%, $7.6 billion), Germany (+43.8%, $105.2 billion), Malaysia (+41.4%, $25.9 billion), Portugal (+39.1%, $9.8 billion), Philippines (+35.2%, $59.3 billion), Sweden (+34.5%, $30 billion), Mexico (+34.5%, $83.7 billion), and Indonesia (+33.7%, $98.1 billion).

What’s clear is the high-growth rates in developing countries, although the growth in several countries, including Germany, Sweden, Denmark, and the Netherlands, is still impressive.

By comparison, the US is the 24th on the list with a CAGR of 16.8% and is projected to reach a transaction value of more than $1 trillion by 2025. Other countries of note include UK (+19.5%, $116.9 billion), India (+19.1%, $401.7 billion), Japan (+13.4%, $310.9 billion), and China (+9.6%, $5.3 trillion).

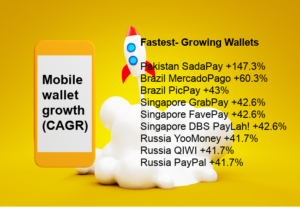

Which mobile wallets will grow fastest?

When it comes to the fastest-growing mobile wallets by transaction value, the data gets very interesting. The largest growth is entirely based in developing countries from a compound annual growth rate, and to many merchants, these mobile wallets are not household names.

Leading the way in transaction value CAGR is SadaPay in Pakistan with a +147.3% reaching $6.1 billion by 2025, followed by Brazil’s MercadoPago (+60.3%, $43.2 billion) and PicPay (+43%, $59.1 billion); Singapore’s GrabPay (+42.6%, $2.8 billion), FavePay (+42.6%, $1.9 billion) and DBS PayLah! (+42.6%, $1.5 billion); Russia’s YooMoney ($22.7 billion), QIWI ($18.7 billion), PayPal ($2.5 billion), and WebMoney ($29.1 billion), each growing at 41.7%.

Rounding out the 15 fastest-growing mobile wallets are Malaysia’s Boost (+40.4%, $6.8 billion), GrabPay (+37.5%, $10.4 billion), and Touch N Go (+37.1%, $9.7 billion); and the Philippines’ GrabPay (+36.6%, $5.4 billion) and PayMaya (+33.2%, $26.6 billion).

The pattern continues through the top 70 fastest-growing mobile wallets. Except for the developed countries of Japan, Taiwan, and South Korea, the fastest-growing mobile wallets are mostly in developing countries.

Western markets will remain slower adopters of mobile wallets

Mobile wallet use in developed countries will lag. Not entirely because of lack of interest, but as mentioned earlier, mainly because North Americans are happier using their debit and credit cards for now. That incremental growth is not enough to close the growth gap with developing countries regarding mobile wallet adoption.

The individual country reports provide detailed market data, identify the most popular mobile wallets in each country, and help gain valuable insight into the mobile payment challenges facing merchants. The Boku report is a valuable addition to global payments research and is recommended reading for payment professionals.

Download the free Boku 2021 Mobile Wallets Report here.

Charts & data provided courtesy of Boku.